Tel:+86 400 118 5939

Tel:+86 400 118 5939Address:Room 2810B, Block A, Tianli Central Plaza, Coastal City, Yuehai Street, Nanshan District, Shenzhen, Guangdong Province

Email:info@hyintern.com

牌照号:TC004750

牌照号:TC004750 Tel:+86 400 118 5939

Tel:+86 400 118 5939Tax incentives increase:

High tech enterprises: Enterprise income tax reduced to 10% (standard tax rate of 20%), export value-added tax 0%;

Special Economic Zones (such as the Maritime Defense Free Trade Zone): Implement "4-year full exemption+9-year halving" of income tax, and foreign experts enjoy visa free residence;

R&D incentive: R&D expenses are deducted at 200% before tax (Law No. 180 of 2025).

Accelerate administrative reform:

The local approval cycle has been shortened by 50% (Hanoi/Haiphong pilot), and the entire registration process for foreign-funded enterprises has been compressed to 14-30 days;

The Haiphong Free Trade Zone has implemented "one-stop approval", reducing document submission by 40%.

Financial support upgrade:

In public-private partnership (PPP) projects, the state bears 70% of the funding for technology projects and shares the revenue risk for the first three years.

2. Industry and location advantagesSupply chain status:

The world's second largest exporter of smartphones, ranked among the top ten in semiconductor exports globally, with a 78% dependence on Sino Vietnamese components;

With the help of 16 free trade agreements (including CPTPP and RCEP), the cost of exporting tariffs to Europe and the United States has been reduced by 30%.

Emerging trend areas:

Digital economy: increasing by 20% annually, the data center market is expected to reach $1.4 billion by 2029;

New energy: In 2024, wind power equipment imports from China will exceed 1 billion US dollars, and priority will be given to land discounts.

📊 2、 Comparison and Selection Guide for Company Types (2025 Adaptation Version) 1 Mainstream company types and applicable scenarios| type | Shareholder/Capital Requirements | Scope of responsibility | Core strengths | Applicable scenarios |

|---|---|---|---|---|

| Limited Liability Company (LLC) | 1-50 people (nationality not limited), recommended registered capital ≥ 100000 US dollars (manufacturing industry) | limited liability | Simple structure, efficient decision-making, and light tax burden | Manufacturing, trade, small and medium-sized foreign-funded enterprises |

| Joint Stock Company (JSC) | ≥ 3 people (unlimited) with a listing threshold of $430000 | limited liability | Capable of public offering and strong financing capability | Medium to large enterprises and companies planning to go public |

| Representative Office (RO) | The parent company has no registered capital requirement for wholly-owned ownership | Market research only | Low cost, fast setup (7 days) | Market testing period enterprises |

| Wholly Foreign Owned Enterprise (WFOE) | 100% foreign controlling capital requirement is the same as LLC | limited liability | Independent operation without local constraints |

💡 Selection strategy:

Trial market: preferred representative office (prohibited from operation) or LLC (low-cost and fast landing);

Long term deep cultivation: choose LLC for manufacturing industry, JSC for financing demand enterprises;

Restricted industries (such as advertising and telecommunications): Joint ventures must be established (with Vietnam holding ≥ 51% of the shares).

⚠️ 3、 2025 Registration Core Requirements and Risk Avoidance 1 Exclusive threshold for foreign investmentRegistered capital

Manufacturing/trade category: ≥ 100000 US dollars (initial 30% operational);

Service category: ≥ 3000 USD (100% paid in within 90 days).

Compliance Enhancement:

Disclosure of Beneficial Ownership: Starting from July 2025, it will be mandatory to register the information of the ultimate controller (including shareholding ratio and identification documents);

Authenticity of Address: The manufacturing industry must have a physical address in the industrial park (requiring an environmental impact assessment report), and false reporting will result in revocation of the license.

2. Industry Access and RestrictionsEncouraged areas:

Semiconductor (Da Nang Free Trade Zone), high-end manufacturing (Haiphong), new energy (Pingshun Province);

Restricted areas:

❌ Prohibited categories: casinos, asbestos production;

⚠️ Joint venture requirements: Telecommunications (Vietnam ≥ 51%), Advertising (foreign investment ≤ 49%).

📍 4、 Regional policy dividends and industrial adaptation 1 Comparison of advantages in key regions| region | Policy Highlights | Adapt to the industry | tax incentives |

|---|---|---|---|

| Coastal Defense Free Trade Zone | Expert visa free, simplified approval by 50% | Port logistics, high-end manufacturing | 4-year tax exemption+9-year halving |

| Da Nang City | Cross border free flow of data | Financial technology and IT outsourcing | Enterprise income tax 10% |

| Beining Province | Samsung supply chain aggregation, full process approval tracking | Electronic assembly, semiconductor | Reduce logistics costs by 15% |

Recommended path: China Holdings → Hong Kong/Singapore companies → Vietnamese entities (using tax treaties to reduce dividend withholding tax to 0%);

Fund management: Prioritize local banks in Vietnam (such as Vietcombank) or Chinese branches to avoid foreign exchange controls.

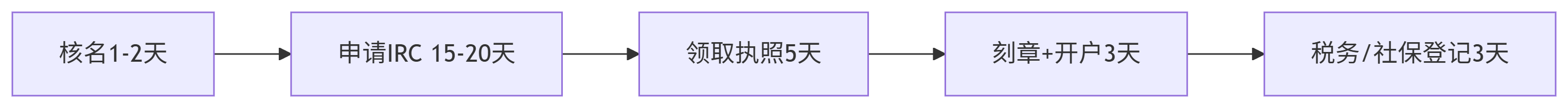

⏳ 5、 Registration Process and Timeframe (2025 Optimized Version)

Total cycle: 28-45 days (manufacturing industry extended by 10-15 days due to environmental impact assessment);

Urgent channel: Entrusting an agent can be shortened to 14 days (local relationship required).

❗ 6、 Key points of risk avoidance and complianceCapital compliance:

Excessive registered capital will result in visa rejection and capital increase review. It is recommended to match actual needs;

Labor management:

Mandatory payment of 17% of wages for social security, and a tiered tax rate of 5% -35% for foreign employees' individual income tax;

Annual maintenance:

Foreign funded enterprises must undergo annual audits, with a penalty of approximately 5% of revenue for overdue payments;

Update the Investment Preferential Certificate every 3 years (if applicable for tax exemptions).

Hongyuan International | One stop Service Expert for Enterprises Going Global

H & Y INTERNATIONAL

core business

✅ Overseas company registration (Hong Kong, Singapore, etc.)

✅ Overseas bank account opening and secretarial services

✅ International tax planning and cross-border financial and tax services

✅ Overseas architecture design and overseas investment filing

✅ Global Intellectual Property and Identity Planning

Service Advantages

-Professional integrity and efficiency: With over 15 years of industry experience, we focus on the global development of enterprises

-One stop solution: from registration to architecture, finance and taxation, identity, covering the entire process

-Butler style customized service: one-on-one professional consultant, tailored overseas plan

-Word of mouth guarantee: helping enterprises expand steadily and win industry trust

Service Advantages

📞 Hotline: 400 118 5939 138 2880 5818 (same as WeChat for mobile phones)

🌐 Service philosophy: Professional planning, efficient execution, helping enterprises set sail globally!

Scan QR code to follow 【Hongyuan International WeChat】

Email: info@hyintern.com

Hotline: +86 400 118 5939