Domestic Parent Company Establishes Overseas Subsidiary For Compliance Remittance of Investment Funds

Overseas Subsidiary Profit Compliance Repatriation to Domestic Parent Company

Listing Compliance Requirements & Establishment of Overseas Equity Incentive Platform

Foreign Companies Opening NRA Accounts in China with Equity Tracing to Individuals or Domestic Enterprises

Foreign Companies Opening Capital Accounts with Equity Involving Domestic Individuals or Enterprises

Familiarity with Relevant Regulations Across Different Jurisdictions

Understanding Reviewers' Preferences and Focus Areas

Quality of Feasibility Studies, Investment Environment Analysis Reports

Interpretation and Forecasting Based on Audit Reports & Financial Data

Specific Content & Format Requirements for Submitting Materials

Accurate Time Estimation for Filing Procedures

Parent Company Business License

Parent Company Business License

Parent Company Audit Report

Parent Company Audit Report

(Net assets must exceed investment amount)

Feasibility Study Report

Feasibility Study Report

Investment Environment Analysis

Investment Environment Analysis

Capital Contribution Resolution

Capital Contribution Resolution

Outbound Investment Filing Form

Outbound Investment Filing Form

Outbound Investment Authenticity Commitment Letter

Outbound Investment Authenticity Commitment Letter

Shareholding Structure Chart

Shareholding Structure Chart

(Must trace to natural persons)

Source of Funds Certificate

Source of Funds Certificate

Sign Project Contract & Pay First Installment

Client Provides Basic Information as Required

Prepare Project Plan Based on Client Information, Multiple Reviews to Finalize

All Documents Stamped According to Official Requirements Submitted to Authorities

Obtain Outbound Investment Approval & Project Filing Certificate

Efficient & Fast Approval

Efficient & Fast Approval

Extensive Successful ExperienceAvailable in Major Cities NationwideRapid Filing Channels

Secure Processing

Secure Processing

One-Time Fee with No Hidden CostsRefund If UnsuccessfulGuaranteed Service

Professional Team Support

Professional Team Support

Senior Consultants Full TrackingAccountant/Lawyer Professional TeamsOne-on-One Professional Service

One-Stop Convenience

One-Stop Convenience

Overseas Company SetupBank Account Opening ServicesCross-Border Tax & Finance Services

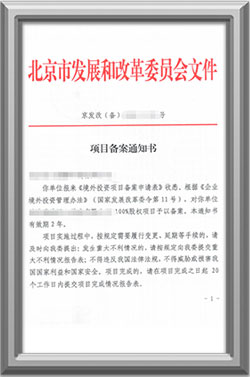

Beijing Development and Reform Commission Filing Notice

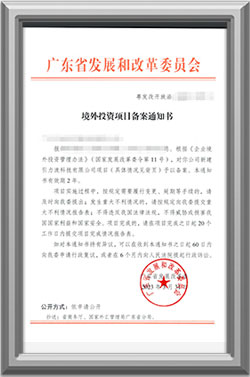

Guangdong Province Development and Reform Commission Filing Notice

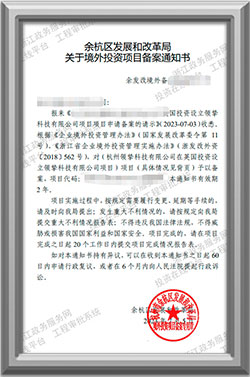

Hangzhou Yuhang District Development and Reform Commission Filing Notice

Outbound Investment Approval (1)

Outbound Investment Approval (2)

Outbound Investment Approval (3)

Outbound Investment Approval (4)