Tel:+86 400 118 5939

Tel:+86 400 118 5939Address:Room 2810B, Block A, Tianli Central Plaza, Coastal City, Yuehai Street, Nanshan District, Shenzhen, Guangdong Province

Email:info@hyintern.com

牌照号:TC004750

牌照号:TC004750 Tel:+86 400 118 5939

Tel:+86 400 118 5939Beijing ODI Filing Guidelines (2025 Policy Edition) Authoritative Basis

Management Measures for Overseas Investment of Enterprises+Document No. 6 of the Beijing Development and Reform Commission [2025]

1、 Beijing's irreplaceable core values

🚩 Policy Heights ✅ National level project channel: Priority approval for strategic investment of central/state-owned enterprises, enjoying "10 working days" for fast completion (2025 new policy) ✅ Green channel privileges: Direct access to digital economy and green energy projects without queuing ✅ Regulatory Transparency: The entire process is tracked online through the Beijing Overseas Investment Management Platform

⚠️ Strict review and warning (VS other cities)

| dimension | Beijing requires | Shenzhen | Shanghai |

|---|---|---|---|

| Financial threshold | Debt ratio<75%+profit | Just need to make a profit | No debt ratio limit |

| Technical supervision | Mandatory submission of 'Technology Export Risk Assessment' | Case review | Simplification of Free Trade Zones |

| Regional rules | Yizhuang enterprises need to declare separately | citywide unified | citywide unified |

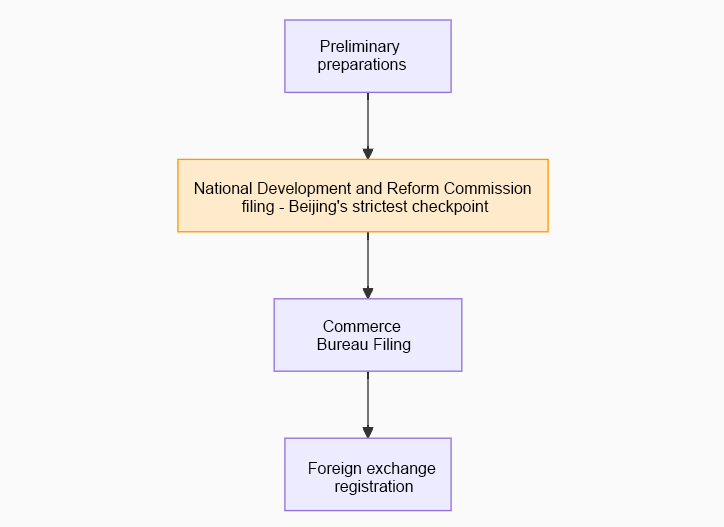

2、 Step by step process and differentiated clearance strategy

1. Filing with the National Development and Reform Commission (10-15 working days)

| key action | Beijing Special Requirements | Comparison between Shenzhen, Shanghai, and Guangzhou |

|---|---|---|

| Financial Review | ⚠️ Double red line: net assets>investment amount+debt ratio<75% | Shenzhen: No debt ratio requirement Guangzhou: Only sufficient net assets are needed |

| technical project | ⚠️ Attached is the 'Technology Export Risk Self Assessment Report' | Shanghai Free Trade Zone: No reporting required |

| System submission | Only accepts Beijing Overseas Investment Management Platform | Shenzhen: Guangdong Government Service Network |

2. Filing with the Commerce Bureau (3-5 working days)

Regional review minefield:

+Chaoyang/Haidian Enterprises → Municipal Bureau of Commerce

+Yizhuang Enterprise → Development Zone Commerce Bureau (appointment system)

-100% return for incorrect submission! (There is no such restriction in Shanghai/Guangzhou)

Certificate validity period: If no remittance is made within 2 years, it needs to be reissued (3 years in Shenzhen)

3. Foreign exchange registration

Large amount of funds (>5 million US dollars): Tax payment certificate is required (Guangzhou>10 million US dollars is required)

Registration upon filing ": Material reuse rate increased by 30% (more efficient than Shanghai)

3、 Material List (Standard) ⚠️ Exclusive to Beijing)

| material | Beijing requires | Simplified project in Shenzhen/Shanghai |

|---|---|---|

| Audit Report | ⚠️ Annotate the calculation process of net assets+proof of debt ratio | Only the basic version is required |

| investment agreement | ⚠️ Must include a clause prohibiting return investment | Shanghai Free Trade Zone can be omitted |

| Proof of funding source | ⚠️ Tax payment voucher required for over 5 million US dollars | Guangzhou requires over 10 million yuan |

| Feasibility Study Report | ⚠️ Add a compliance chapter for technology export | The the Belt and Road project in Chengdu is free of submission |

💡 Alternative solution:

Excessive debt ratio → declared by the parent company entity of the group

No tax payment certificate → Batch remittance (single transaction < 5 million)

4、 Enterprise Self Help Guide (Updated in 2025)

| high-frequency scenarios | Legitimate path | minefield |

|---|---|---|

| Insufficient net assets | ✅ Capital injection to increase net assets (operated 6 months in advance) ✅ Staged investment (initial investment less than 50% of net assets) | ❌ False capital increase → administrative penalty |

| Technology sensitive projects | ✅ Declaration after divesting core technology ✅ Take the channel of "international scientific research cooperation" | ❌ Concealing affiliation → Dishonest list |

| Yizhuang Enterprise Application | ✅ Make an appointment with the Business Bureau of the Development Zone 3 days in advance | ❌ Missubmitted to the municipal bureau → delayed by 15 days |

Hongyuan International | One stop Service Expert for Enterprises Going Global

H & Y INTERNATIONAL

core business

✅ Overseas company registration (Hong Kong, Singapore, etc.)

✅ Overseas bank account opening and secretarial services

✅ International tax planning and cross-border financial and tax services

✅ Overseas architecture design and overseas investment filing

✅ Global Intellectual Property and Identity Planning

Service Advantages

-Professional integrity and efficiency: With over 15 years of industry experience, we focus on the global development of enterprises

-One stop solution: from registration to architecture, finance and taxation, identity, covering the entire process

-Butler style customized service: one-on-one professional consultant, tailored overseas plan

-Word of mouth guarantee: helping enterprises expand steadily and win industry trust

Service Advantages

📞 Hotline: 400 118 5939 138 2880 5818 (same as WeChat for mobile phones)

🌐 Service philosophy: Professional planning, efficient execution, helping enterprises set sail globally!

Scan QR code to follow 【Hongyuan International WeChat】

Email: info@hyintern.com

Hotline: +86 400 118 5939