Tel:+86 400 118 5939

Tel:+86 400 118 5939Address:Room 2810B, Block A, Tianli Central Plaza, Coastal City, Yuehai Street, Nanshan District, Shenzhen, Guangdong Province

Email:info@hyintern.com

牌照号:TC004750

牌照号:TC004750

Tel:+86 400 118 5939

Tel:+86 400 118 5939Hong Kong Offshore Profits Tax Exemption Guide | Official Policy Disassembly+Adaptability Self Testing, Compliance Achieving Zero Tax Burden on Overseas Profits

According to Article 14 of the Inland Revenue Ordinance, profits not originating from Hong Kong are not subject to profits tax

1、 Offshore Exemption Core Policy - Official Standards of the Hong Kong Inland Revenue Department ✅ Three elements of tax exemption (latest implementation criteria in 2025)

| element | Tax bureau verification method | Compliance Points |

|---|---|---|

| Business decision-making location | Board Records/Email/IP Address | It is necessary to prove that core decisions such as pricing and contract signing were made overseas |

| Supply Chain Trajectory | Logistics documents/customs code | Goods are not transshipped or stored in Hong Kong |

| Customers and Funds | Bank statements/signing location | The receiving account is not registered in Hong Kong, and the customer is mainly located overseas |

⚠️ Upgrade of Inspection in 2025 (Notice No. 12 of the Tax Bureau)

New evidence item: Digital business trajectory must be provided (such as e-commerce platform backend and server logs)

Prohibited by law: Hong Kong accounts are used as a "bridge for posting" (same day transactions are considered as operating in Hong Kong)

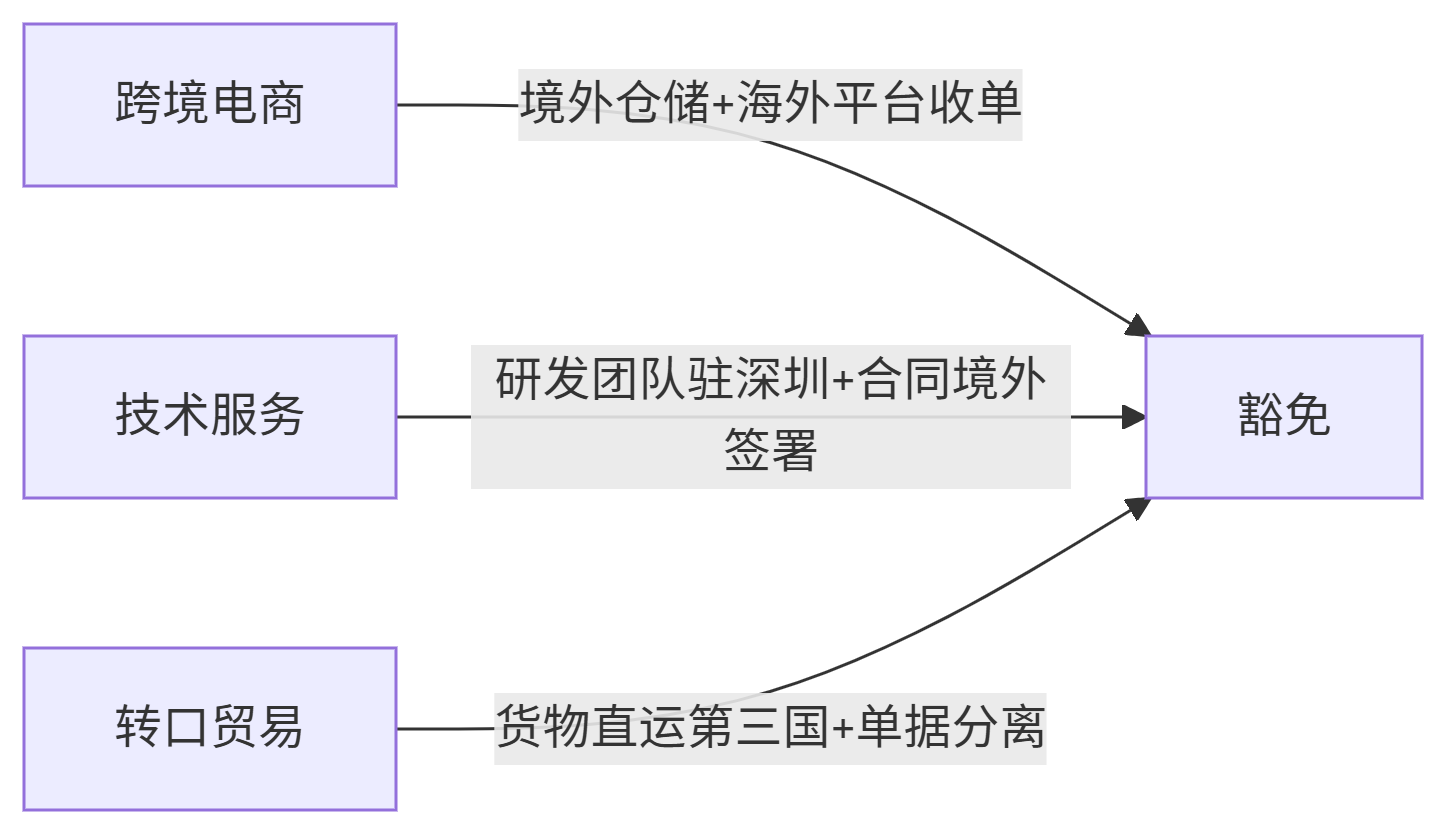

2、 Your Business Adaptability Diagnosis - Ubiquitous Scenario Analysis ▍ Highly Adaptable Industry (Past Successful Case Types)

Risk Warning: These architectures will lead to application failure

❌ Dual contract model: Hong Kong companies sign contracts but actually subcontract to mainland China (tax authorities penetrate to identify profit sources in Hong Kong)

❌ Hong Kong directors sign and approve purchase orders (even if the supplier is overseas)

❌ PayPal linked to Hong Kong bank account for withdrawal (requires using offshore account for receipt)

💡 Compliance path reference: The original structure of a customer's rectification plan was: Hong Kong account received payment from Europe and America → transferred to the mainland parent company the next day after adjustment:

Open a Singapore receiving account

Mainland teams sign contracts with electronic signatures

The board resolution record shows that the decision was made in Shenzhen, and the exemption was successfully obtained

3、 Our service value - precise escort based on official rules ✅ Offshore exemption from fourth tier services (100% based on tax laws)

| phase | Service Content | Policy Basis |

|---|---|---|

| Architecture pre check | Compare Article 14 of the Tax Regulations with DIPN No. 49 | Issue the Offshore Adaptation Rating Form |

| Evidence chain construction | Collect digital evidence as required by Notice No. 12 of the Tax Bureau | Generate an officially recognized 'Business Trajectory Report' |

| Defense deduction | 48 high-frequency inquiries from simulated tax bureau (sourced from actual case library) | Pre fill in the 'Inquiry Response Template' |

| Archive Maintenance | Annual update of board records and supply chain evidence | Meet the requirement of a 7-year traceability period |

✅ Endorsement of True Service Capability

Qualification announcement: The principal holds a Hong Kong TIHK tax accountant license

Technical tool: Offshore Evidence Chain Storage System (funded by Hong Kong Cyberport Innovation Fund)

Official cooperation: Jointly released the "Offshore Exemption Operation Guidelines" with the Hong Kong Institute of Certified Public Accountants

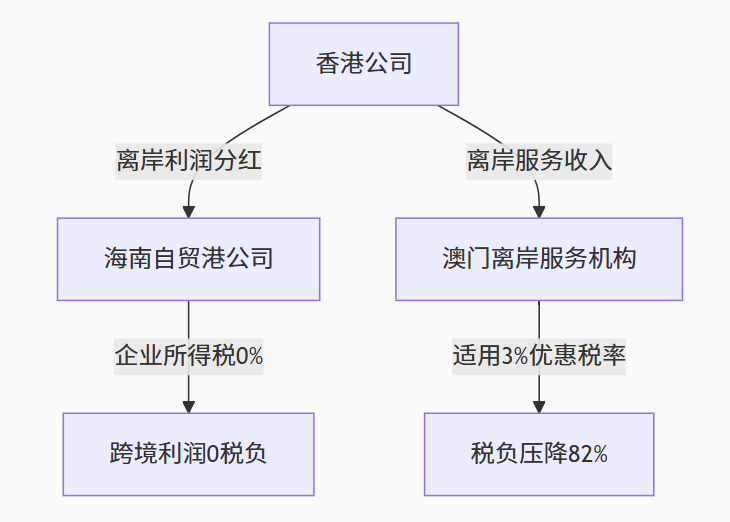

4、 Offshore Exemption+Cross border Dividend - Example of Policy Combination Fist 💡 Compliance overlay provincial tax path (universal model)

Note: The specific effect needs to be customized and calculated according to the enterprise architecture

5、 Dare to Promise Service Guarantee - Risk Sharing Mechanism

| Service process | Promise terms | legal basis |

|---|---|---|

| Construction of Evidence Chain | If rejected due to missing materials, free replacement and reconstruction will be provided | Article 3.2 of the Service Agreement |

| Audit response | Due to report defects resulting in fines, bear 50% of the fine | Additional Insurance Terms |

| Long term compliance | Within 3 years after the exemption is approved, if the tax is pursued, the full amount of the tax will be compensated | Lifetime Escort Agreement |

Hongyuan International | One stop Service Expert for Enterprises Going Global

H & Y INTERNATIONAL

core business

✅ Overseas company registration (Hong Kong, Singapore, etc.)

✅ Overseas bank account opening and secretarial services

✅ International tax planning and cross-border financial and tax services

✅ Overseas architecture design and overseas investment filing

✅ Global Intellectual Property and Identity Planning

Service Advantages

-Professional integrity and efficiency: With over 15 years of industry experience, we focus on the global development of enterprises

-One stop solution: from registration to architecture, finance and taxation, identity, covering the entire process

-Butler style customized service: one-on-one professional consultant, tailored overseas plan

-Word of mouth guarantee: helping enterprises expand steadily and win industry trust

Service Advantages

📞 Hotline: 400 118 5939 138 2880 5818 (same as WeChat for mobile phones)

🌐 Service philosophy: Professional planning, efficient execution, helping enterprises set sail globally!

Scan QR code to follow 【Hongyuan International WeChat】

Email: info@hyintern.com

Hotline: +86 400 118 5939