Tel:+86 400 118 5939

Tel:+86 400 118 5939Address:Room 2810B, Block A, Tianli Central Plaza, Coastal City, Yuehai Street, Nanshan District, Shenzhen, Guangdong Province

Email:info@hyintern.com

牌照号:TC004750

牌照号:TC004750 Tel:+86 400 118 5939

Tel:+86 400 118 5939As is well known, Hong Kong is a global commercial port with advantages such as free flow of people, good infrastructure, and free flow of logistics. In terms of company registration, there are differences between the regulations for registering companies in Hong Kong and mainland China. For example, there are significant differences in the minimum requirements for registered capital for companies in Hong Kong. So, what is the minimum requirement for registered capital for companies in Hong Kong? Next, Hongyuan International will take you on a look together.

The so-called registered capital is also known as nominal capital. Hong Kong companies are limited by shares, and the registered capital of a company is generally divided into several shares of a certain amount per share. The amount of registered capital represents the maximum amount of funds that a company can raise, which is the maximum amount of shares that the company can sell to shareholders.

The registered capital of a Hong Kong company does not need to be verified: the sufficient registered capital often directly affects the decision of shareholders whether to establish a company. In Hong Kong, regardless of the registered capital, there is no need to transfer the funds to a Hong Kong bank.

The minimum requirements for registered capital of Hong Kong companies are as follows:

1. The minimum registered capital for a Hong Kong company is 1 yuan, with no upper limit.

2. The registered capital in Hong Kong adopts a subscription system. After shareholders subscribe to the share capital, there is no specific requirement for the time when the share capital is due, unless otherwise specified in the articles of association.

3. The currency used for the registered capital of Hong Kong companies can be selected according to customer needs, including Hong Kong dollars, US dollars, Chinese yuan, etc.

4. In March 2014, the government issued a new company regulation that abolished the requirement to submit a unit price per share for filing when registering a new company. This means that only the registered capital amount and total number of shares need to be submitted, and there is no record of the value of a single share when registering a new company.

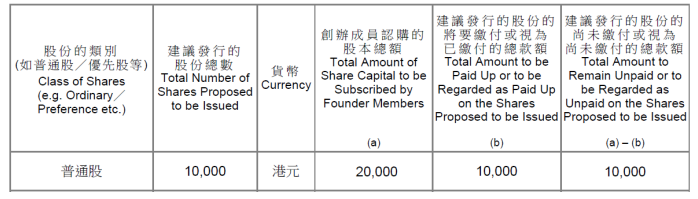

5. Stock Category - Common Stock

6. Factors to consider:

(1) If the company is liquidated in the later stage, the higher the registered capital, the lawyer will require shareholders to pay in the registered capital and repay the company's debts; If equity transfer is carried out in the later stage, the higher the registered capital, the higher the stamp duty involved.

(2) Most customers believe that the higher the registered capital, the stronger the company's strength, so some customers are willing to choose a higher registered capital.

Can the registered capital be increased after the company is established? After the registration and establishment of a Hong Kong company, the registered capital can be increased at will, but a shareholders' meeting must be convened and a resolution to increase the registered capital must be passed. The resolution must be submitted to the Hong Kong Companies Registry along with the completed specified form and appropriate fees.

For more questions about the registered share capital of Hong Kong companies, you can consult Hongyuan International.

Scan QR code to follow 【Hongyuan International WeChat】

Email: info@hyintern.com

Hotline: +86 400 118 5939