Tel:+86 400 118 5939

Tel:+86 400 118 5939Address:Room 2810B, Block A, Tianli Central Plaza, Coastal City, Yuehai Street, Nanshan District, Shenzhen, Guangdong Province

Email:info@hyintern.com

牌照号:TC004750

牌照号:TC004750 Tel:+86 400 118 5939

Tel:+86 400 118 5939When enterprises move towards internationalization, corporate structure is no longer an "option", but a strategic starting point. Unreasonable architecture may lead to increased tax burden, low efficiency, risk exposure, and compliance risks.

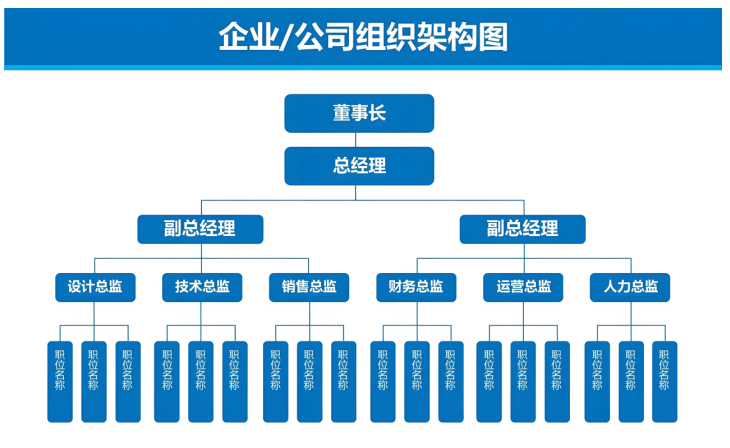

Our global architecture design services aim to help you achieve five major goals: 🛡️ Risk isolation: Separation of legal entities to ensure independent operation of core assets and high-risk businesses 💸 Tax burden optimization: compliant application of policies from various jurisdictions to reduce global effective tax rates ⚡ ● Efficiency improvement: Optimize equity and capital flow, improve management and decision-making efficiency 📈 ● Financing convenience: Design red chip/VIE and other architectures to pave the way for financing and listing 👨👩👧👦 ● Inheritance planning: Integrating family trusts to achieve secure inheritance of wealth

🎯 2、 Core service scenarios

🎯 2、 Core service scenarios1. The architecture design for mainland enterprises to go global aims to create efficient and compliant solutions for manufacturing, trade, and technology enterprises. Common mode: Chinese parent company → Hong Kong/Singapore holding → Overseas operating company Value highlights: 🌏 Reduce dividend and interest withholding tax 🏢 Centralized management of regional headquarters, procurement, or IP ownership 🚧 Avoiding foreign investment review and investment barriers

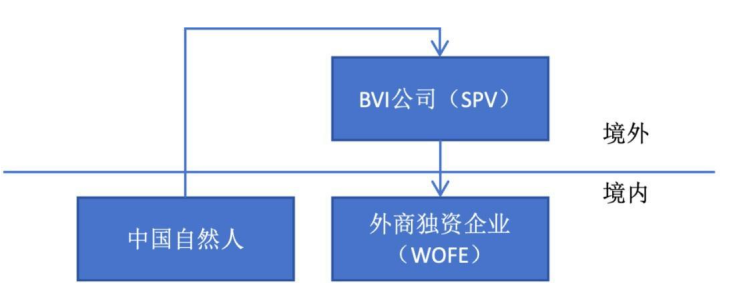

2. Offshore architecture design and optimization utilize the advantages of BVI, Cayman Islands, Samoa and other places to serve different business purposes: 🔴 Red chip structure: Cayman Islands as the listing entity, BVI as the holding platform, suitable for Hong Kong/US stock listings 🏛️ VIE architecture: addressing control issues in industries restricted by foreign investment 👪 Family control: asset protection and inheritance through offshore companies or trusts

3. Group restructuring and optimization provides system restructuring services for existing complex or inefficient structures, including equity transfer, business/cash flow restructuring, and company entity streamlining, to help you cope with regulatory changes and maintain structural flexibility.

🚀 3、 Four step service process

🚀 3、 Four step service process1. Diagnosis and Target Confirmation - Comprehensive Understanding of Business Model, Equity, and Strategic Objectives 2 Scheme design and argumentation - provide multiple scheme comparisons, evaluate legal and tax feasibility 3 Presentation and Refinement - Clarify Implementation Path, Costs, and Potential Risks 4 Landing and Support - Responsible for company registration, account opening, tax registration, and long-term compliance maintenance

💎 4、 Core advantages🌐 ● Global perspective · Cross disciplinary expertise: The team has experience in international taxation, law, and investment and financing 📊 ● Forward looking layout · Compliance first: in line with global anti tax avoidance rules such as the Economic Substance Law and CFC 🔄 One stop service system: full coverage of architecture consulting, registration, secretarial services, annual review, and tax reporting 🛡️ Prioritizing customer interests: Adhering to compliance and prudent planning, safeguarding your international business security

✨ An excellent company structure is the highway to the global market. Starting from the starting point of departure, let a professional team plan the best route for you. Book an appointment with a global architecture consultant now to receive 1-on-1 preliminary consultation and exclusive architecture blueprint!

Scan QR code to follow 【Hongyuan International WeChat】

Email: info@hyintern.com

Hotline: +86 400 118 5939